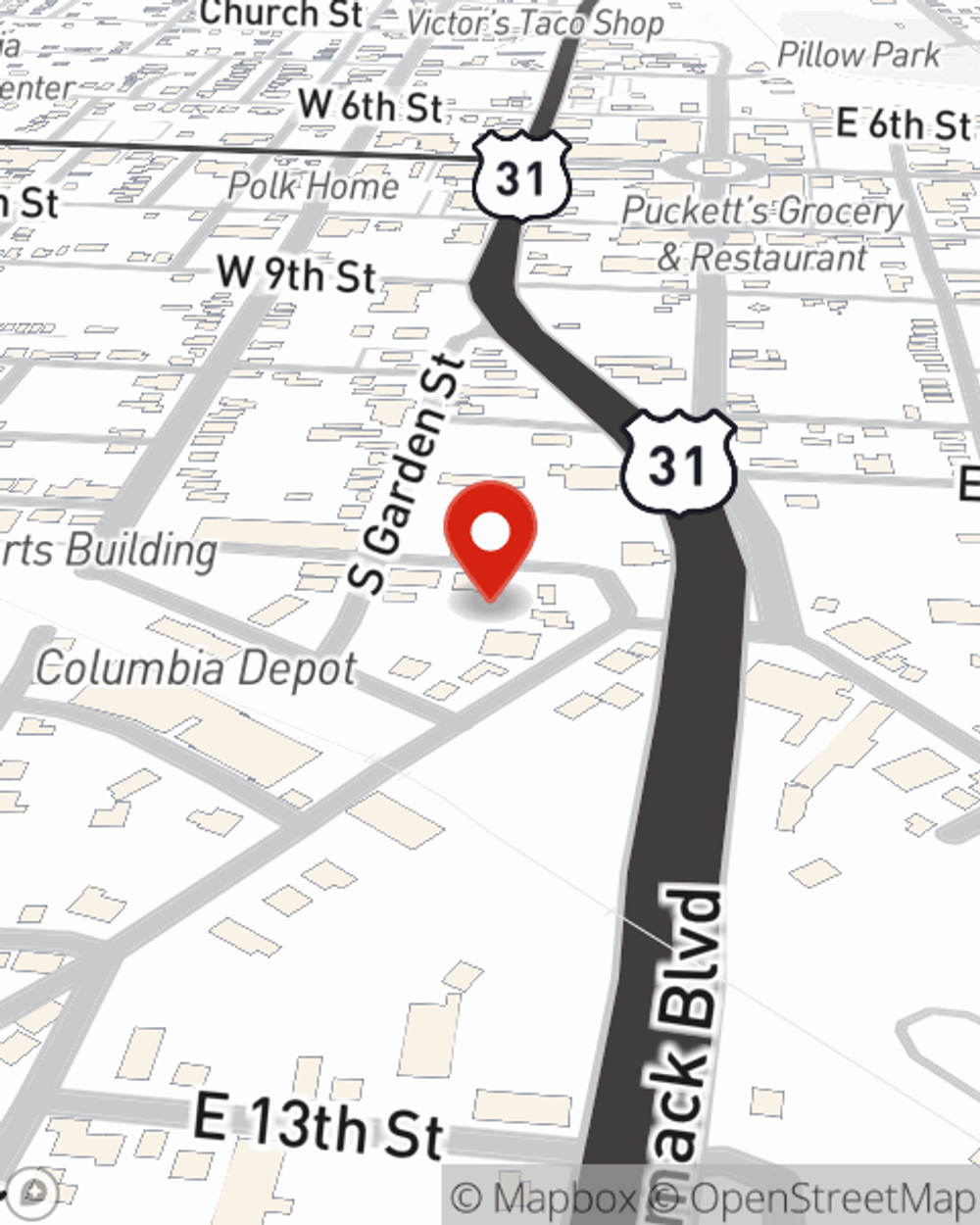

Business Insurance in and around Columbia

Calling all small business owners of Columbia!

Almost 100 years of helping small businesses

- Columbia

- Mount Pleasant

- Spring Hill

- Franklin

- Dickson

- Lewisburg

- Lawrenceburg

- Shelbyville

- Brentwood

- Nashville

- Fairview

- Kingston Springs

- Lyles

- Williamson County

- Marshall County

- Giles County

- Lawrence County

- Lewis County

- Dickson County

- Maury County

- Hickman County

- Culleoka

This Coverage Is Worth It.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes problems like a customer stumbling and falling can happen on your business's property.

Calling all small business owners of Columbia!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent JennaLynn Drake can not only help you design a policy that will fit your needs, but can also help you submit a claim should a mishap like this arise.

Don’t let worries about your business keep you up at night! Call or email State Farm agent JennaLynn Drake today, and explore how you can benefit from State Farm small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

JennaLynn Drake

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.